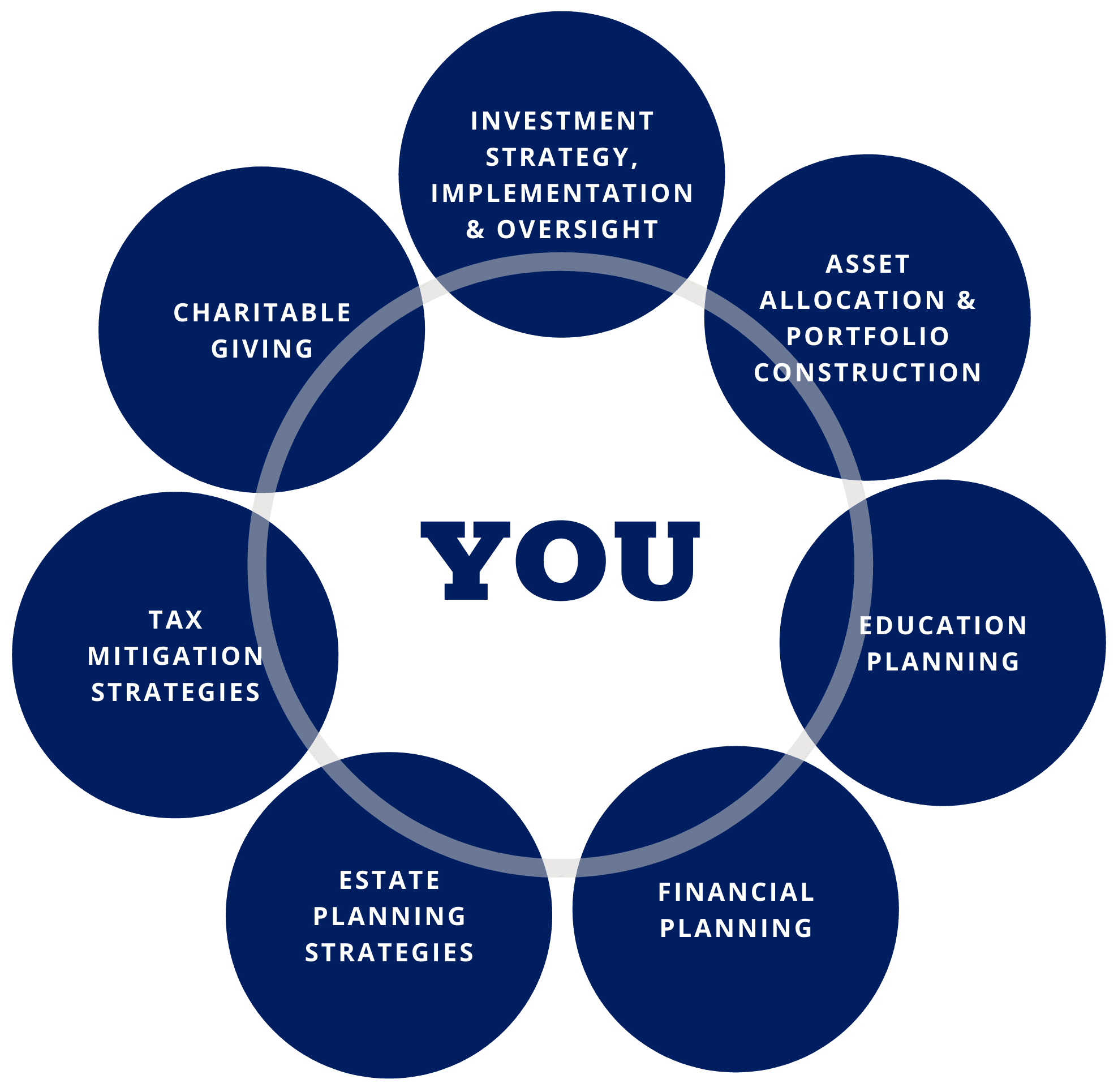

What We Do

Investments

Our client’s portfolios are constructed by dedicated, full-time and credentialed professionals on Fragasso’s portfolio management team. From small and simple diversified portfolios to complex portfolios that utilize a multi-disciplined approach, we have you covered. Portfolios are monitored and rebalanced quarterly, to keep your investments in-line with your risk profile, through the ever-changing market cycles, and to reduce and minimize capital gains taxes through tax-harvesting strategies. Fragasso has no proprietary products and utilizes low-cost investments with low or no trade costs, in order to minimize your fees.

Wealth Management

You have built a nest egg. Now you want to preserve it for both your lifetime and those of your heirs and charities. In addition to investment management, as your personal advisor, it is important for us to be part of your overall planning. Whether we are helping you with insurance needs, your budgets, or meetings with your accountant, attorneys, and key family members or business partners, we want you to know that we understand the high level of commitment that goes along with being a trusted advisor for you and your family.

Retirement Planning

One of the areas of greatest uncertainty for investors, is knowing how much to save, how long to save, how much is enough, and how much to take out when they need it in retirement. Said in another way, “how long will my money last?” Although we cannot predict the markets, we certainly can help you create goals, and strategies to achieve those goals. By utilizing historical performances and market cycles, we help you gain a better understanding of compound interest, risk & reward profiles, types of retirement savings vehicles, both personally and at the workplace, and withdrawal strategies. We help you monitor and adjust, for the most predictable opportunity for your assets to last through your lifetime and beyond, if desired.

Insurance & Annuities

How much life insurance should I have today? Is the insurance at my workplace enough? What kind of life insurance is best for me at this time: whole, universal or term life?

Should I buy or exchange an annuity? What kind of annuity is best for me: fixed or variable, immediate or deferred? If I did buy an annuity, is it still the best option for me currently? Are the riders adequate? Do I need to change the investment options or rebalance?

Should I buy long term care insurance, a hybrid policy that combines long term care with some other insurance, like life insurance or an annuity? Should I just self-insure?

Is the disability policy my employer provides for me sufficient for my needs today and years from now? What does it cover, or not cover? What if I cannot continue in my current career that I have heavily invested my time and money?

We offer insurance reviews to all our clients, to determine the amount of insurance they need, have, and to uncover any gaps that exist. They can then choose whether they wish to fill those gaps, to protect themselves and their loved ones from potential disaster and hardship. We will also provide a no-obligation review or comparison of your current insurance and annuity policies, so you can decide if it would be prudent to make any necessary or desired changes.

Retirement Plans

Whether you are a one-person sole proprietor, small S-Corp business with a handful of employees, or a large organization with multiple offices and departments, we would welcome the opportunity to discuss ways to start, manage, or enhance your retirement plan. As a retirement plan specialist and Accredited Investment Fiduciary (AIF), backed by the Fragasso Retirement Plan Advisors Department, and with the many top-notch retirement plan consultants in the region, we are well equipped to help you design and manage a retirement plan. We offer SEP & SIMPLE IRAs, 401(k), 403(b), Profit Sharing, and Pension & Cash Balance Plans. Properly designed and monitored retirement plans help attract & retain quality employees and reward key employees. Business owners, who have sacrificed their retirement savings by reinvesting their revenues back into the business over the years, can accelerate their savings as they approach their retirement or exit in a tax-efficient manner.

Group Voluntary Benefits

Not all employers are able to offer and pay for a full suite of employee benefits. Most employers offer health, term life and maybe either short-term or long-term disability insurance. Many employees want and need more options to supplement what their employer can afford.

Through payroll deduction, there are many options available in the voluntary benefit space. Since the early 90’s, Section 125 of the Internal Revenue Code has made many of these benefits available on a pre-tax basis. For a no-obligation and comprehensive review of available options in the marketplace, we act as an independent broker, bringing to you what we feel is the best product fit, according to your needs, your employees’ needs, costs, and available service models.

Most often, new clients who call us initially state how appreciative they are that we took the time to listen, evaluate, and explain in a manner they could understand, and develop workable strategies to help them set and achieve their goals.